Market Definition

The market focuses on the production and application of concrete mixtures specifically designed for submerged or water-saturated environments. This specialized formulations ensure strength, durability, and resistance to washout, making them suitable for marine structures, bridge piers, underwater tunnels, dams, and ports.

The report covers key trends, technological advancements, and regulatory standards influencing the demand for underwater concrete in new construction and repair across civil, industrial, and infrastructure sectors.

Underwater Concrete Market Overview

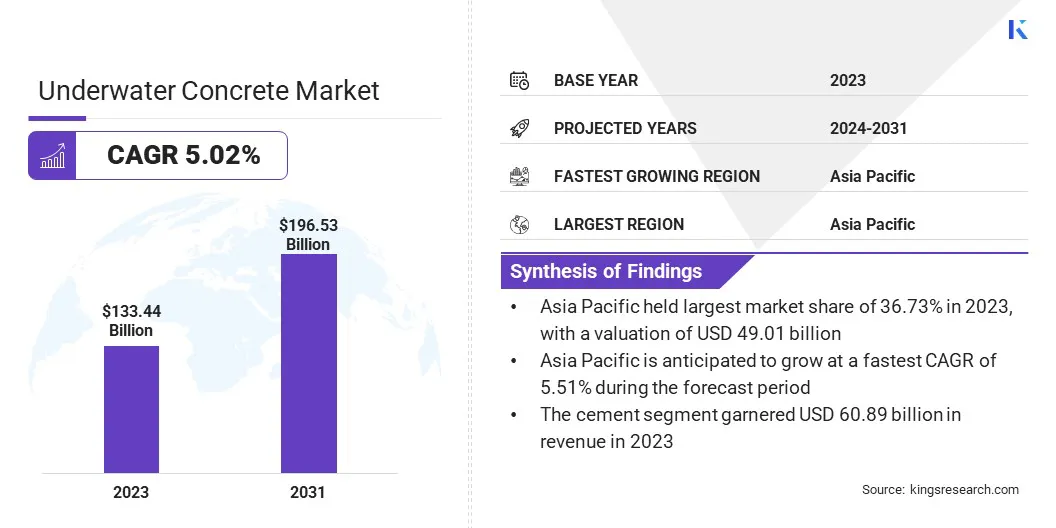

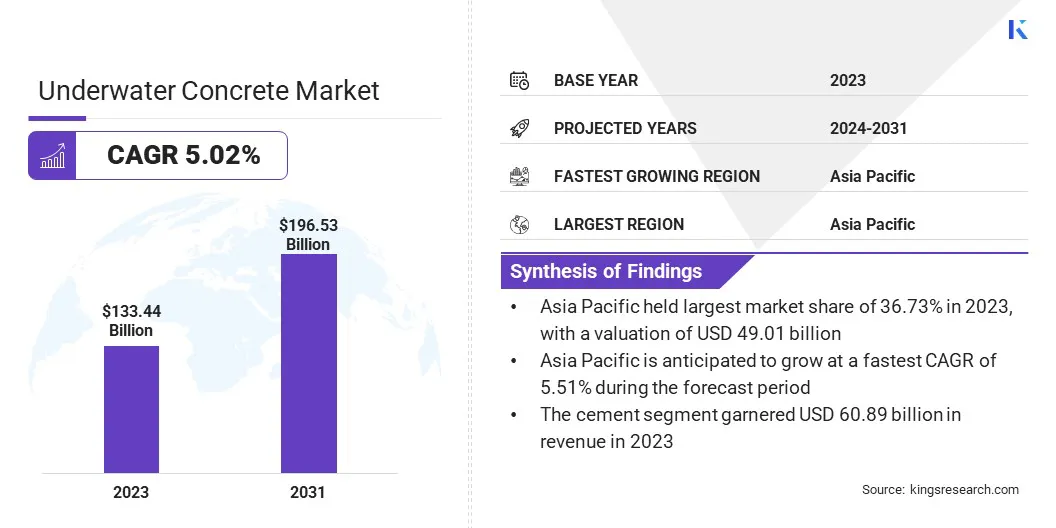

The global underwater concrete market size was valued at USD 133.44 billion in 2023 and is projected to grow from USD 139.45 billion in 2024 to USD 196.53 billion by 2031, exhibiting a CAGR of 5.02% during the forecast period.

This growth is propelled by increasing global infrastructure development in coastal and offshore regions. The rising demand for durable construction materials in submerged environments such as bridges, tunnels, ports, and hydropower facilities is driving adoption.

Major companies operating in the underwater concrete industry are Sika AG, BASF SE, LafargeHolcim Ltd., CEMEX S.A.B. de C.V., Heidelberg Materials, Dow, GCP Applied Technologies Inc., Xypex Chemical Corporation, Mapei S.p.A., Fosroc, Kryton International Inc., Sapei S.A., Nox-Crete, Inc., Saint-Gobain, and PPG Industries.

Rapid urbanization and the expansion of maritime trade are leading to significant investments in waterfront infrastructure. Governments are prioritizing underwater construction for coastal protection, port expansion, and offshore energy installations.

Additionally, advancements in anti-washout admixtures and placement techniques are improving performance and enabling more complex underwater construction.

- In March 2024, the Government of India launched its first underwater metro line beneath the Hooghly River in Kolkata. The project included a 520-meter underwater tunnel constructed using specialized underwater concrete to withstand high water pressure and prevent washout.

Key Highlights

- The underwater concrete industry size was valued at USD 133.44 billion in 2023.

- The market is projected to grow at a CAGR of 5.02% from 2024 to 2031.

- Asia Pacific held a market share of 36.73% in 2023, with a valuation of USD 49.01 billion.

- The cement segment garnered USD 60.89 billion in revenue in 2023.

- The marine construction segment is expected to reach USD 80.41 billion by 2031.

- Europe is anticipated to grow at a CAGR of 5.22% over the forecast period.

Market Driver

"Rising Investments in Coastal and Offshore Infrastructure"

Growing global investments in coastal protection, offshore energy, and marine transportation are peopelling the growth of the underwater concrete market.

Governments and private sectors are increasingly deploying underwater concrete in applications such as ports, bridges, underwater tunnels, and offshore wind farms due to its high durability and resistance to saline and submerged environments. These factors are accelerating market expansion across both developed and emerging economies.

- In October 2023, the Indian government approved the Vizhinjam International Seaport project in Kerala. This project will extensively use underwater concrete in the breakwater construction to withstand high wave action and saline conditions.

Market Challenge

"Difficulties in Quality Control During Underwater Placement"

Maintaining consistent quality and structural integrity during underwater concrete placement poses a significant challenge to the progress of the underwater concrete market.

Unlike conventional concrete pouring, underwater construction is highly sensitive to factors such as water movement, sediment disturbance, and mix segregation. These technical hurdles increase the likelihood of structural defects, delay project timelines, and raise overall costs, particularly in large-scale marine or infrastructure projects.

To address this challenge, key players are investing heavily in advanced mix designs and anti-washout admixtures that enhance cohesion and reduce segregation during underwater placement.

Market Trend

"Integration of Fiber-Reinforced Concrete for Enhanced Durability"

The underwater concrete market is witnessing a notable shift toward the use of fiber-reinforced concrete (FRC), supported by rising demand for enhanced structural performance and durability in challenging marine environments.

FRC offers superior crack resistance, reduced permeability, and greater load-bearing capacity, making it well-suited for submerged structures such as tunnels, foundations, and offshore platforms.

Governments and contractors are increasingly adopting this advanced material to extend the service life of critical infrastructure while reducing long-term maintenance costs.

The trend is further supported by innovations in material engineering that allow for better integration of synthetic and steel fibers within concrete mixes designed specifically for underwater placement.

- In October 2023, Bangladesh inaugurated the Karnaphuli Underwater Tunnel, South Asia’s first underwater road tunnel. The project incorporated advanced concrete technologies, including FRC, for a resilient and sustainable underwater construction.

Underwater Concrete Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

Admixture, Cement, Aggregate, Others

|

|

By Application

|

Marine Construction, Hydro Projects, Tunnels, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material (Admixture, Cement, Aggregate, and Others): The cement segment earned USD 60.89 billion in 2023 due to its strong binding properties, durability in submerged conditions, and widespread availability.

- By Application (Marine Construction, Hydro Projects, Tunnels, and Others): The marine construction segment held a share of 38.55% in 2023, propelled by its extensive use in building and repairing ports, bridges, and offshore structures.

Underwater Concrete Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific underwater concrete market share stood at around 36.73% in 2023, valued at USD 49.01 billion. This dominance is facilitated by rapid infrastructure development and large-scale marine construction projects across countries such as China, Japan, South Korea, and India.

The region’s extensive coastline and ongoing investments in port expansion, underwater tunnels, bridges, and offshore structures are fueling demand for underwater concrete solutions.

Government-led infrastructure programs, such as China’s Belt and Road Initiative and India’s Sagarmala project, are further boosting regional market growth. Additionally, rising investments in hydropower and offshore energy projects across Southeast Asia are contributing to the region’s dominance. Strong construction activity and the presence of key raw material suppliers support domestic market expansion.

- In November 2023, China completed the final concrete pour for the immersed tube tunnel of the Shenzhen-Zhongshan Link a key project within the Greater Bay Area transport network. The tunnel utilized advanced underwater concrete to support durability in marine conditions.

Europe underwater concrete industry is estimated to grow at a robust CAGR of 5.22% over the forecast period. This rapid growth is bolstered by the expansion of offshore renewable energy projects and the modernization of aging marine infrastructure.

Countries such as Denmark, the Netherlands, and Germany are investing in offshore wind farms in the North Sea and Baltic Sea, which require durable underwater concrete for foundations and support structures.

In addition, several European nations are upgrading their aging port and coastal infrastructure to meet current safety and performance standards, boosting the demand for high-performance underwater concrete solutions across the region.

Regulatory Frameworks

- In the U.S., underwater concrete applications must comply with standards set by agencies such as the Environmental Protection Agency (EPA) and the U.S. Army Corps of Engineers, ensuring water quality protection and structural integrity. The Clean Water Act also requires permits for construction in navigable waters, with the emphasis on environmental impact mitigation.

- In the EU, underwater concrete use is regulated under directives such as the Water Framework Directive and EN 206 standards, emphasizing strict controls on concrete formulation and durability in marine environments. Environmental impact assessments are required to ensure compliance with marine preservation and sustainability goals.

Competitive Landscape

The underwater concrete industry is highly competitive, with several key players focusing on technology advancement and customized product offerings to gain a competitive edge.

Companies are investing in R&D to improve concrete performance in challenging underwater conditions, focusing on enhanced resistance to washout, higher compressive strength, and optimized setting times.

Strategic partnerships with construction firms and infrastructure developers are enabling joint development of project-specific solutions. Additionally, players are expanding their presence in emerging markets across Asia Pacific and the Middle East through localized production, distribution networks, and collaborations with regional contractors.

List of Key Companies in Underwater Concrete Market:

- Sika AG

- BASF SE

- LafargeHolcim Ltd.

- CEMEX S.A.B. de C.V.

- Heidelberg Materials

- Dow

- GCP Applied Technologies Inc.

- Xypex Chemical Corporation

- Mapei S.p.A.

- Fosroc

- Kryton International Inc.

- Sapei S.A.

- Nox-Crete, Inc.

- Saint-Gobain

- PPG Industries

Recent Developments (Expansion)

- In April 2025, Sika inaugurated a new production facility in Ust-Kamenogorsk, Kazakhstan, dedicated to manufacturing concrete admixtures and mortars. This marks Sika’s fourth plant in the country and includes a modern laboratory to support product development and quality control.